Tax Season is Coming: Dates to Watch For

For business owners, tax season can be quite daunting. Don’t get lost in the deadlines and due dates! The American Institute of Professional Bookkeepers has released a Tax Calendar and a list of Payroll due dates all businesses should be mindful of in the coming months. Below is a helpful guide to refer to when keeping your business organized this tax season.

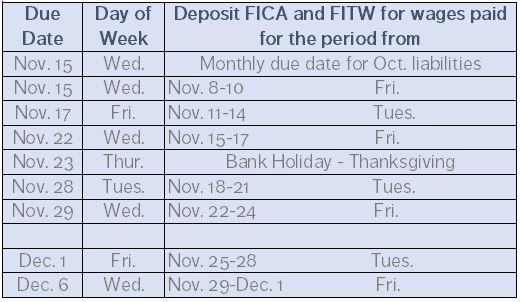

Tax Calendar

American Institute of Professional Bookkeepers

It is important to remember:

The only acceptable reason for delaying deposit of payroll taxes due is a legal federal holiday

Deposits of $100,000 or more must be made within one business day of the day that the tax liability is incurred.

Year-End 2017 Due Dates

BEFORE DECEMBER 1, 2017

- Remind employees on or before this date if that if there has been a change in their filing status due to marriage, divorce, or dependents (birth, adoption, child turning 21), they may want to file a new W-4 for 2018

- Make sure employee paycheck names and SSNs match their SS cards and W-4 data. Consider using the SSA’s SSN Verification Service.

- Employers can elect to use the Special Accounting Rule and treat employee personal use of a company-provided vehicle in November and December as “paid” in 2018.

BY DECEMBER 31, 2017

- For tax purposes, wages paid by check or electronically after this date are generally 2018 wages, even if earned in 2017.

- Check all SS withheld. If any employee paid more than the 2017 limit of $7,886.40, make an adjustment or refund before making your final tax-year 2017 deposit. Leave enough time to make adjustments and refunds.

- Regardless of whether you use a payroll service, verify that all special wage payments and adjustments are correctly posted to 2017 earnings before processing 2017 W-2s, including:

- taxable relocation expense reimbursements;

- group-term life insurance in excess of $50,000;

- third-party sick pay;

- manual or voided paychecks not in your system;

- personal use of company vehicles, taxable parking and/or company-provided transportation;

- employer-paid child care above the annual limit;

- company-paid taxable educational assistance;

- taxable noncash payments; and

- other taxable items paid outside of the payroll system.

- Report 2017 pay on 2017 W-2s, provided that the employee had access to the wages without substantial limitation or restriction.

- Remember, even if a paycheck is dated 2018, if the employee had access to it in 2017, include the wages and taxes on the 2017 W-2.

**Information in this article was provided by the American Institute of Professional Bookkeepers and Tax Notes Today (November Article)