Updates to Travel Reimbursement per diems.

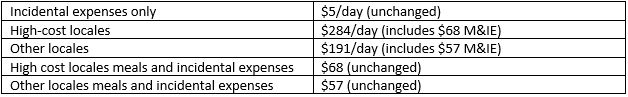

With the holidays coming up, traveling for pleasure will certainly be on the rise. But we didn’t forget about those businesses who are still recording travel expenses! According to the American Institute of Professional Bookkeepers, travel reimbursement per diems have been updated. These federal per diem rates can be used by businesses to reimburse employees for business travel expenses without detailed substantiation. We have included these changes and other important qualifications to help small businesses make sense of their accounts.

*rates are effective October 1, 2017 (or January 1st, 2018)

These federal per diem rates include meals and incidental expenses (M&IE). Incidental expenses include fees and tips for porters, baggage carriers, hotel staff, and staff on ships.

J. Zollo & Associates, Inc wishes everyone safe travels, whether for business or pleasure.

**Information in this article was provided by the American Institute of Professional Bookkeepers and Tax Notes Today (November Article)